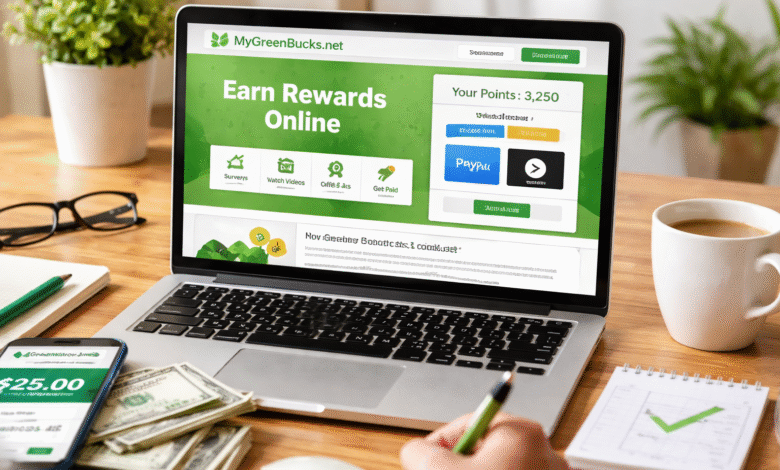

In a crowded digital world, readers gravitate toward platforms that offer clarity, consistency, and practical value. Financial and savings-focused content has become especially important as people try to make smarter decisions in uncertain times. Among the sites that have caught attention, latest news mygreenbucks.net has become a familiar phrase for readers looking to stay informed about money trends, saving habits, and practical financial insights.

What draws people in is not just the promise of updates, but the way information is framed. Readers want news that feels relevant to daily life. They want explanations that do not talk down to them, and they want guidance that respects their time. When a platform manages to combine those elements, it naturally builds trust. That trust is what turns casual visitors into regular readers who return to see what has changed, what is trending, and what might help them make better choices this week.

This article explores how news-driven content in the personal finance and rewards space is evolving, what readers expect from updates today, and why staying current matters. We will look at how platforms shape their news sections, what kinds of stories tend to resonate, and how readers can use updates to sharpen their financial awareness without feeling overwhelmed.

Why Timely Updates Matter in Personal Finance

Money-related decisions are rarely static. What worked last year may not make sense today. Interest rates shift. Consumer trends change. New tools and services appear. Even the way people think about budgeting evolves with lifestyle changes. In that environment, timely updates help people adjust their strategies before small issues become bigger problems.

For many readers, checking updates is not about chasing every headline. It is about spotting patterns. When a platform consistently highlights emerging trends, it helps readers notice changes in how people save, spend, and invest. This broader perspective can shape everyday decisions, from choosing where to shop to how to plan for the next few months.

Another reason timely updates matter is confidence. People feel more secure when they believe they are informed. They may not act on every piece of news, but knowing what is happening reduces anxiety. It replaces uncertainty with context. That emotional reassurance is a quiet but powerful benefit of staying current.

What People Expect From latest news mygreenbucks.net

When readers search for latest news mygreenbucks.net, they are often looking for more than a list of updates. They want context. They want to understand why something matters and how it connects to their own financial habits. A strong news section does not simply report changes. It interprets them.

One expectation is clarity. Financial topics can feel dense, especially when they involve technical terms or shifting policies. Readers appreciate when updates are written in plain language. Clear explanations help them grasp the practical impact without needing to decode jargon.

Another expectation is relevance. Not every financial update applies to every reader. The most engaging news focuses on issues that touch everyday life, such as saving strategies, digital tools, or consumer behavior. When readers feel that an update reflects their own concerns, they are more likely to stay engaged and return.

Consistency also matters. People develop habits around information sources. If updates appear sporadically or change tone frequently, trust erodes. A steady rhythm of thoughtful content helps readers feel anchored. Over time, they begin to rely on the platform as part of their routine.

The Types of Stories That Resonate Most

Not all news captures attention equally. Certain story types consistently resonate with readers in the personal finance space.

One popular category is practical guidance. Updates that offer simple steps to improve saving habits or manage everyday expenses tend to perform well. These stories give readers something concrete to try. They move beyond abstract trends and translate information into action.

Another category is trend analysis. Readers like to understand where things are heading. Stories that explore shifts in consumer behavior, digital tools, or reward systems help people anticipate change. Even if they do not act immediately, they appreciate having a sense of direction.

Personal stories and real-world examples also hold strong appeal. When updates include relatable scenarios, readers can see themselves in the narrative. This human element turns news into something more than data. It becomes a shared experience, which strengthens engagement.

Finally, explanatory pieces that unpack complex topics play a key role. Many financial concepts are intimidating at first glance. When news content breaks them down into approachable language, it empowers readers. Knowledge feels less like a barrier and more like a tool.

How News Content Shapes Financial Habits

Information does not just inform. It shapes behavior. Over time, the updates people read influence how they think about money. Subtle shifts in perspective can lead to meaningful changes in habit.

For example, repeated exposure to stories about mindful spending can encourage readers to pause before making impulsive purchases. Updates that highlight small saving techniques may inspire people to adopt simple routines. Even stories about mistakes can be valuable, as they help readers avoid common pitfalls.

The cumulative effect of news content is often more important than any single article. Each update adds a small layer of understanding. Over months, those layers form a more confident and informed mindset. Readers may not remember every detail, but they internalize patterns. They become more aware of choices and consequences.

This is why platforms that prioritize thoughtful updates can have a real impact on their audience. They are not just sharing information. They are shaping how people approach their financial lives.

The Role of Transparency and Trust

In a space where misinformation can spread easily, trust is everything. Readers are increasingly cautious about where they get their financial information. They look for signs of transparency. They want to know that updates are grounded in reasonable analysis and presented without hidden agendas.

Trust grows when platforms acknowledge uncertainty. Not every trend is predictable. Not every tool works the same way for every person. When news content reflects this nuance, readers feel respected. They are more likely to engage critically rather than blindly follow advice.

Another aspect of trust is tone. Updates that feel balanced and measured tend to resonate more than those that rely on hype. Readers appreciate when content avoids exaggeration and instead focuses on practical implications. A calm, thoughtful voice builds credibility over time.

When trust is established, readers are more willing to return regularly. They view the platform not just as a source of updates, but as a companion in their financial journey.

How Readers Can Use News Without Feeling Overwhelmed

Staying informed does not mean consuming every update. One challenge many readers face is information overload. The constant flow of news can feel exhausting. The key is to approach updates with intention.

One helpful strategy is to focus on themes rather than individual headlines. Instead of reacting to every piece of news, readers can look for recurring patterns. Are there consistent messages about saving habits. Are certain tools gaining attention. This thematic approach reduces noise and highlights what truly matters.

Another approach is to set boundaries. Checking updates at a regular but limited interval can prevent burnout. For example, reviewing news once or twice a week allows readers to stay informed without feeling pressured to keep up constantly.

Finally, readers can reflect on how news applies to their own situation. Not every update requires action. Sometimes the value lies in awareness. By filtering information through personal goals, readers can decide what to adopt and what to simply note for future reference.

The Human Side of Financial Updates

Behind every update is a human story. Even when news focuses on trends or tools, it ultimately reflects how people are navigating their financial lives. Recognizing this human element can change how readers engage with content.

When readers see themselves in the challenges described, they feel less alone. Financial stress can be isolating. News that acknowledges common struggles fosters a sense of shared experience. It reminds readers that others are facing similar questions and uncertainties.

This emotional connection is often what keeps people coming back. They are not just seeking information. They are seeking reassurance that their efforts to manage money are part of a broader, collective journey. News becomes a mirror of everyday life, reflecting both challenges and small victories.

The Broader Context of Digital Financial News

The way people consume financial news has changed dramatically. Short updates, mobile-friendly formats, and conversational tones have replaced long, formal reports. Readers expect content to fit into their daily routines. They might read updates during a commute or a quick break. This shift has influenced how platforms structure their news sections.

Brevity does not mean superficiality. The most effective updates combine concise writing with meaningful insight. They respect the reader’s time while still offering substance. This balance is difficult to achieve, but when done well, it enhances engagement.

Another change is interactivity. Readers often want to feel involved. Even when content is one-directional, the tone can invite reflection. Questions, prompts, and relatable examples encourage readers to think about how news applies to their own lives. This interactive feel deepens the impact of each update.

How Platforms Evolve With Reader Needs

No platform remains static. As reader expectations change, news sections evolve. Topics that once dominated attention may fade, replaced by new concerns. The platforms that endure are those that listen to their audience and adapt accordingly.

This evolution often involves experimenting with content formats. Some readers prefer in-depth explanations. Others want quick takeaways. A diverse mix of formats helps reach a broader audience. It also keeps the experience fresh, preventing monotony.

Feedback loops play a role as well. When readers engage more with certain types of stories, platforms learn what resonates. Over time, this shapes editorial direction. The result is a news section that feels increasingly aligned with its audience’s real-world needs.

The Long-Term Value of Staying Informed

Staying informed is not about perfection. It is about gradual improvement. Over time, regular exposure to thoughtful updates builds a stronger foundation of knowledge. Readers become more comfortable navigating financial topics. They learn to ask better questions and make more deliberate choices.

This long-term value extends beyond specific tips or trends. It cultivates a mindset of awareness. Readers who regularly engage with updates tend to be more attentive to their own habits. They notice where they can adjust, where they are doing well, and where they might need support.

In this sense, following updates is an investment in personal growth. The return on that investment may not be immediate, but it accumulates quietly. Each insight adds to a broader understanding of how to manage resources with intention.

Conclusion

The steady flow of updates in the personal finance space reflects how dynamic our financial lives have become. When readers look for latest news mygreenbucks.net, they are ultimately seeking clarity, relevance, and reassurance. They want information that fits into real life, respects their intelligence, and helps them navigate everyday decisions with greater confidence.

By engaging thoughtfully with updates, readers can turn information into insight. Over time, that insight shapes habits, reduces uncertainty, and supports more mindful choices. In a world where change is constant, staying informed becomes less about chasing headlines and more about building a steady, grounded understanding of what truly matters.

FAQs

What kind of updates does MyGreenBucks.net usually share?

The platform focuses on personal finance trends, saving habits, practical money tips, and insights that relate to everyday financial decisions.

How often should readers check for new updates?

Checking once or twice a week is usually enough to stay informed without feeling overwhelmed by too much information.

Are the updates useful for beginners in personal finance?

Yes, the content is generally written in clear language, making it accessible for readers who are just starting to learn about managing money.

Can following financial updates really change daily habits?

Over time, regular exposure to practical insights can encourage more mindful spending, better saving routines, and improved financial awareness.

Is it necessary to act on every piece of financial news?

No. Many updates are best viewed as context and awareness. Readers can choose what fits their goals and ignore what does not apply to their situation.